Employees and insured persons regularly receive information about their acquired pension entitlements, including annually from the age of 27 from German pension insurance or through private insurers. This information is used to calculate the expected net pension or a possible pension gap. In addition, such information can be used for customer insights, e.g., in Beyond Banking.

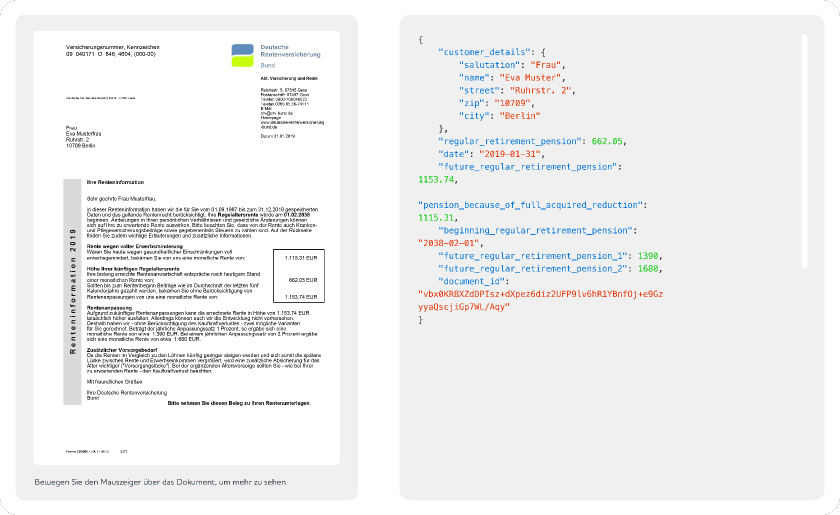

Using fintract OCR-API, the digitization of pension information is quite simple. Optical text recognition (OCR = Optical Character Recognition) automatically reads data from documents, extracts it in real-time, and converts it into structured data. The data output is JSON and then transferred to your system via a REST API interface. You can quickly implement a connection to existing systems, such as a customer relationship management system (CRM), cost-effectively. This way, pension data can be processed promptly, e.g., to calculate pension gaps or create customer profiles.

Our OCR reliably reads individual pension data. This includes:

fintract OCR has already been used for many years in various business areas.

Therefore, we can guarantee fast integration, especially for the digitization of standard documents.

You would like to digitize additional or particularly extensive documents?

No problem – we are constantly expanding our product range and

continuously training our OCR.